175x Filetype PDF File size 0.07 MB Source: www.irs.gov

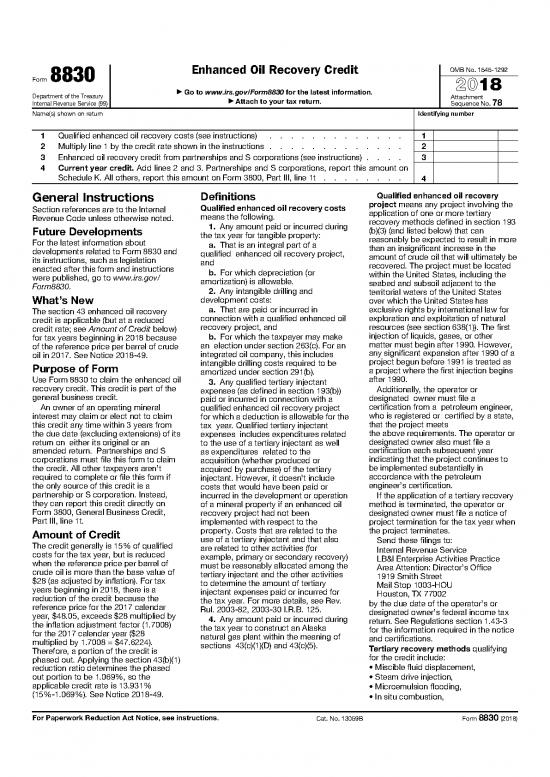

Form 8830 Enhanced Oil Recovery Credit OMB No. 1545-1292

▶ 2018

Department of the Treasury Go to www.irs.gov/Form8830 for the latest information. Attachment

Internal Revenue Service (99) ▶ Attach to your tax return. Sequence No. 78

Name(s) shown on return Identifying number

1 Qualified enhanced oil recovery costs (see instructions) . . . . . . . . . . . . . 1

2 Multiply line 1 by the credit rate shown in the instructions . . . . . . . . . . . . . 2

3 Enhanced oil recovery credit from partnerships and S corporations (see instructions) . . . . 3

4 Current year credit. Add lines 2 and 3. Partnerships and S corporations, report this amount on

Schedule K. All others, report this amount on Form 3800, Part III, line 1t . . . . . . . . 4

General Instructions Definitions Qualified enhanced oil recovery

Section references are to the Internal Qualified enhanced oil recovery costs project means any project involving the

Revenue Code unless otherwise noted. means the following. application of one or more tertiary

1. Any amount paid or incurred during recovery methods defined in section 193

Future Developments the tax year for tangible property: (b)(3) (and listed below) that can

For the latest information about a. That is an integral part of a reasonably be expected to result in more

developments related to Form 8830 and qualified enhanced oil recovery project, than an insignificant increase in the

its instructions, such as legislation and amount of crude oil that will ultimately be

enacted after this form and instructions b. For which depreciation (or recovered. The project must be located

were published, go to www.irs.gov/ amortization) is allowable. within the United States, including the

Form8830. seabed and subsoil adjacent to the

2. Any intangible drilling and territorial waters of the United States

What’s New development costs: over which the United States has

The section 43 enhanced oil recovery a. That are paid or incurred in exclusive rights by international law for

credit is applicable (but at a reduced connection with a qualified enhanced oil exploration and exploitation of natural

credit rate; see Amount of Credit below) recovery project, and resources (see section 638(1)). The first

for tax years beginning in 2018 because b. For which the taxpayer may make injection of liquids, gases, or other

of the reference price per barrel of crude an election under section 263(c). For an matter must begin after 1990. However,

oil in 2017. See Notice 2018-49. integrated oil company, this includes any significant expansion after 1990 of a

Purpose of Form intangible drilling costs required to be project begun before 1991 is treated as

amortized under section 291(b). a project where the first injection begins

Use Form 8830 to claim the enhanced oil 3. Any qualified tertiary injectant after 1990.

recovery credit. This credit is part of the expenses (as defined in section 193(b)) Additionally, the operator or

general business credit. paid or incurred in connection with a designated owner must file a

An owner of an operating mineral qualified enhanced oil recovery project certification from a petroleum engineer,

interest may claim or elect not to claim for which a deduction is allowable for the who is registered or certified by a state,

this credit any time within 3 years from tax year. Qualified tertiary injectant that the project meets

the due date (excluding extensions) of its expenses includes expenditures related the above requirements. The operator or

return on either its original or an to the use of a tertiary injectant as well designated owner also must file a

amended return. Partnerships and S as expenditures related to the certification each subsequent year

corporations must file this form to claim acquisition (whether produced or indicating that the project continues to

the credit. All other taxpayers aren’t acquired by purchase) of the tertiary be implemented substantially in

required to complete or file this form if injectant. However, it doesn’t include accordance with the petroleum

the only source of this credit is a costs that would have been paid or engineer’s certification.

partnership or S corporation. Instead, incurred in the development or operation If the application of a tertiary recovery

they can report this credit directly on of a mineral property if an enhanced oil method is terminated, the operator or

Form 3800, General Business Credit, recovery project had not been designated owner must file a notice of

Part III, line 1t. implemented with respect to the project termination for the tax year when

Amount of Credit property. Costs that are related to the the project terminates.

The credit generally is 15% of qualified use of a tertiary injectant and that also Send these filings to:

costs for the tax year, but is reduced are related to other activities (for Internal Revenue Service

when the reference price per barrel of example, primary or secondary recovery) LB&I Enterprise Activities Practice

crude oil is more than the base value of must be reasonably allocated among the Area Attention: Director’s Office

$28 (as adjusted by inflation). For tax tertiary injectant and the other activities 1919 Smith Street

years beginning in 2018, there is a to determine the amount of tertiary Mail Stop 1003-HOU

reduction of the credit because the injectant expenses paid or incurred for Houston, TX 77002

reference price for the 2017 calendar the tax year. For more details, see Rev. by the due date of the operator’s or

year, $48.05, exceeds $28 multiplied by Rul. 2003-82, 2003-30 I.R.B. 125. designated owner’s federal income tax

the inflation adjustment factor (1.7008) 4. Any amount paid or incurred during return. See Regulations section 1.43-3

for the 2017 calendar year ($28 the tax year to construct an Alaska for the information required in the notice

multiplied by 1.7008 = $47.6224). natural gas plant within the meaning of and certifications.

Therefore, a portion of the credit is sections 43(c)(1)(D) and 43(c)(5). Tertiary recovery methods qualifying

phased out. Applying the section 43(b)(1) for the credit include:

reduction ratio determines the phased • Miscible fluid displacement,

out portion to be 1.069%, so the • Steam drive injection,

applicable credit rate is 13.931% • Microemulsion flooding,

(15%-1.069%). See Notice 2018-49. • In situ combustion,

For Paperwork Reduction Act Notice, see instructions. Cat. No. 13059B Form 8830 (2018)

Form 8830 (2018) Page 2

• Polymer-augmented water flooding, Line 3 The time needed to complete and file

• Cyclic-steam injection, Enter total enhanced oil recovery credits this form will vary depending on

• Alkaline (or caustic) flooding, from: individual circumstances. The estimated

• Carbonated water flooding, • Schedule K-1 (Form 1065), Partner’s burden for individual and business

• Immiscible nonhydrocarbon gas Share of Income, Deductions, Credits, taxpayers filing this form is approved

displacement, or etc., box 15 (code P); and under OMB control number 1545-0074

• Any other method approved by the • Schedule K-1 (Form 1120S), and 1545-0123 and is included in the

Secretary of the Treasury. Shareholder’s Share of Income, estimates shown in the instructions for

Deductions, Credits, etc., box 13 (code their individual and business income tax

P). return. The estimated burden for all other

Specific Instructions Partnerships and S corporations must taxpayers who file this form is shown

Figure any enhanced oil recovery credit always report the above credits on line 3. below.

from your own trade or business on lines All other taxpayers: Recordkeeping . . . 5 hr., 15 min.

1 and 2. Skip lines 1 and 2 if you’re only • Report the above credits directly on Learning about the

claiming a credit that was allocated to Form 3800, Part III, line 1t; and law or the form . . . . . . 53 min.

you from an S corporation or a • Don’t file Form 8830. Preparing and

partnership. sending the form

Line 1 Paperwork Reduction Act Notice. We to the IRS . . . . . . .1hr., 1 min.

Enter the total of the qualified costs paid ask for the information on this form to If you have comments concerning the

or incurred during the year in connection carry out the Internal Revenue laws of accuracy of these time estimates or

with a qualified enhanced oil recovery the United States. You are required to suggestions for making this form

project. See Definitions above. give us the information. We need it to simpler, we would be happy to hear from

Reduce the otherwise allowable ensure that you are complying with these you. See the instructions for the tax

deductions for line 1 costs by the line 2 laws and to allow us to figure and collect return with which this form is filed.

credit attributable to these costs. Also, if the right amount of tax.

any part of the line 1 costs are for You are not required to provide the

expenditures that increase the basis of information requested on a form that is

property, reduce the otherwise allowable subject to the Paperwork Reduction Act

basis increase by the line 2 credit unless the form displays a valid OMB

attributable to these costs. control number. Books or records

Line 2 relating to a form or its instructions must

Multiply line 1 by 13.931% (0.13931). be retained as long as their contents

may become material in the

administration of any Internal Revenue

law. Generally, tax returns and return

information are confidential, as required

by section 6103.

no reviews yet

Please Login to review.