141x Filetype PDF File size 0.03 MB Source: mfe.baruch.cuny.edu

Syllabus for MTH 9862 file:///home/elena/teaching/fincal/syllabus.html

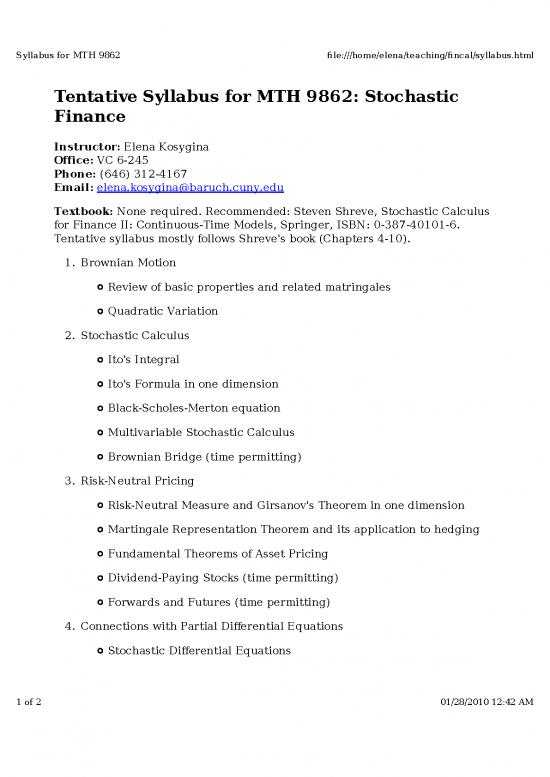

Tentative Syllabus for MTH 9862: Stochastic

Finance

Instructor: Elena Kosygina

Office: VC 6-245

Phone: (646) 312-4167

Email: elena.kosygina@baruch.cuny.edu

Textbook: None required. Recommended: Steven Shreve, Stochastic Calculus

for Finance II: Continuous-Time Models, Springer, ISBN: 0-387-40101-6.

Tentative syllabus mostly follows Shreve's book (Chapters 4-10).

1. Brownian Motion

Review of basic properties and related matringales

Quadratic Variation

2. Stochastic Calculus

Ito's Integral

Ito's Formula in one dimension

Black-Scholes-Merton equation

Multivariable Stochastic Calculus

Brownian Bridge (time permitting)

3. Risk-Neutral Pricing

Risk-Neutral Measure and Girsanov's Theorem in one dimension

Martingale Representation Theorem and its application to hedging

Fundamental Theorems of Asset Pricing

Dividend-Paying Stocks (time permitting)

Forwards and Futures (time permitting)

4. Connections with Partial Differential Equations

Stochastic Differential Equations

1 of 2 01/28/2010 12:42 AM

Syllabus for MTH 9862 file:///home/elena/teaching/fincal/syllabus.html

Partial Differential Equations

Feynman-Kac formula

5. Exotic Options

Maximum of Brownian Motion with Drift

Knock-out Barrier Options

Lookback Options (time permitting)

Asian Options

6. American Derivative Securities

Perpetual Americal Put

Finite-Expiration American Put

7. Numeraires. Forward Measures.

8. Term Structure Models

Affine Yield Models

Heath-Jarrow-Morton Model

Forward LIBOR Model

2 of 2 01/28/2010 12:42 AM

no reviews yet

Please Login to review.