216x Filetype XLS File size 0.16 MB Source: www1.adp.ca

Sheet 1: Introduction

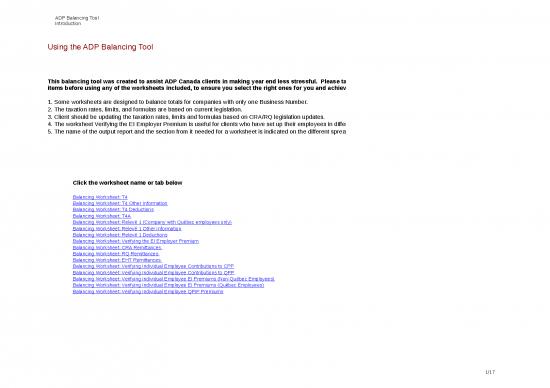

| Using the ADP Balancing Tool | ||||||||||||||

| This balancing tool was created to assist ADP Canada clients in making year end less stressful. Please take note of the following items before using any of the worksheets included, to ensure you select the right ones for you and achieve accurate results. |

||||||||||||||

| 1. Some worksheets are designed to balance totals for companies with only one Business Number. | ||||||||||||||

| 2. The taxation rates, limits, and formulas are based on current legislation. | ||||||||||||||

| 3. Client should be updating the taxation rates, limits and formulas based on CRA/RQ legislation updates. | ||||||||||||||

| 4. The worksheet Verifying the EI Employer Premium is useful for clients who have set up their employees in different branches or departments depending on the BN they belong to. | ||||||||||||||

| 5. The name of the output report and the section from it needed for a worksheet is indicated on the different spreadsheets. | ||||||||||||||

| Click the worksheet name or tab below | ||||||||||||||

| Balancing Worksheet: T4 | ||||||||||||||

| Balancing Worksheet: T4 Other Information | ||||||||||||||

| Balancing Worksheet: T4 Deductions | ||||||||||||||

| Balancing Worksheet: T4A | ||||||||||||||

| Balancing Worksheet: Relevé 1 (Company with Québec employees only) | ||||||||||||||

| Balancing Worksheet: Relevé 1 Other Information | ||||||||||||||

| Balancing Worksheet: Relevé 1 Deductions | ||||||||||||||

| Balancing Worksheet: Verifying the EI Employer Premium | ||||||||||||||

| Balancing Worksheet: CRA Remittances | ||||||||||||||

| Balancing Worksheet: RQ Remittances | ||||||||||||||

| Balancing Worksheet: EHT Remittances | ||||||||||||||

| Balancing Worksheet: Verifying Individual Employee Contributions to CPP | ||||||||||||||

| Balancing Worksheet: Verifying Individual Employee Contributions to QPP | ||||||||||||||

| Balancing Worksheet: Verifying Individual Employee EI Premiums (Non-Québec Employees) | ||||||||||||||

| Balancing Worksheet: Verifying Individual Employee EI Premiums (Québec Employees) | ||||||||||||||

| Balancing Worksheet: Verifying Individual Employee QPIP Premiums | ||||||||||||||

| Balancing Worksheet: T4 | ||

| T4 Box 14 (Employment Income) | ||

| TOTALS REPORT | ||

| EARNINGS NUMBER | EARNINGS NAME | YTD TOTAL |

| 01 | REGULAR | |

| 02 | OVERTIME | |

| Grand Total | - | |

| GRAND TOTAL FROM TOTALS REPORT | - | |

| REPORT OF TAX FORM BALANCES | ||

| DIFFERENCE | - | |

| Balancing Worksheet: T4 | |||||

| Other Information Area on the T4 | |||||

| OTHER INFORMATION AREA | TOTALS REPORT | REPORT OF TAX FORM BALANCES TAX FORMS COLUMN | DIFFERENCE | ||

| CODE | DESCRIPTION | EARN # | YTD TOTAL | ||

| Code 30 | Board and Lodging | - | |||

| Code 31 | Special work site | - | |||

| Code 32 | Travel in a prescribed zone | - | |||

| Code 33 | Medical travel assistance | - | |||

| Code 34 | Personal use of employer’s automobile or motor vehicle | - | |||

| Code 36 | Interest free and low interest loan | - | |||

| Code 37 | Employee home relocation loan deduction | - | |||

| Code 38 | Security options benefits | - | |||

| Code 39 | Security options deduction 110 (1)(d) | - | |||

| Code 40 | Other Benefits and Allowances | - | |||

| Life insurance | - | ||||

| RRSP | - | ||||

| Car allowance | - | ||||

| Code 41 | Security options deduction 110 (1)(d.1) | - | |||

| Code 42 | Employment commissions | - | |||

| Code 43 | Canadian Forces personnel and police deduction | - | |||

| Code 66 | Retirement allowances eligible | - | |||

| Code 67 | Retirement allowances non eligible | - | |||

| Code 68 | Eligible Retiring Allowance-Status Indian | - | |||

| Code 69 | Non-Eligible Reriting Allowance-Status Indian | - | |||

| Code 70 | Municipal officer’s expense allowance | - | |||

| Code 71 | Status Indian employee | - | |||

| Code 77 | Workers compensation benefits repaid to the employer | - | |||

| Code 78 | Fishers gross earnings | - | |||

| Code 79 | Fishers net partnership amount | - | |||

| Code 80 | Fishers shareperson amount | - | |||

| Code 81 | Placement/employment agency workers gross earnings | - | |||

| Code 82 | Taxi Drivers and other passenger carrying vehicles gross earnings | - | |||

| Code 83 | Barbers or hairdressers gross earnings | - | |||

| Code 86 | Security Options Election (Cash out) | - | |||

| Code 87 | Volunteer Fighter exempt amount | - | |||

no reviews yet

Please Login to review.