194x Filetype XLS File size 1.58 MB Source: www.msmlm.com

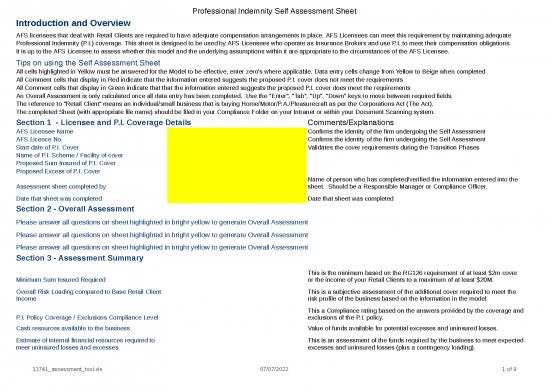

Professional Indemnity Self Assessment Sheet

Introduction and Overview

AFS licensees that deal with Retail Clients are required to have adequate compensation arrangements in place. AFS Licensees can meet this requirement by maintaining adequate

Professional Indemnity (P.I.) coverage. This sheet is designed to be used by AFS Licensees who operate as Insurance Brokers and use P.I. to meet their compensation obligations.

It is up to the AFS Licensee to assess whether this model and the underlying assumptions within it are appropriate to the circumstances of the AFS Licensee.

Tips on using the Self Assessment Sheet

All cells highlighted in Yellow must be answered for the Model to be effective, enter zero's where applicable. Data entry cells change from Yellow to Beige when completed

All Comment cells that display in Red indicate that the information entered suggests the proposed P.I. cover does not meet the requirements

All Comment cells that display in Green indicate that that the information entered suggests the proposed P.I. cover does meet the requirements Required

An Overall Assessment is only calculated once all data entry has been completed. Use the "Enter", "Tab", "Up", "Down" keys to move between required fields.

The reference to "Retail Client" means an individual/small business that is buying Home/Motor/P.A./Pleasurecraft as per the Corporations Act (The Act).

The completed Sheet (with appropriate file name) should be filed in your Compliance Folder on your Intranet or within your Document Scanning system.

Section 1 - Licensee and P.I. Coverage Details Comments/Explanations

AFS Licensee Name Confirms the identity of the firm undergoing the Self Assessment

AFS Licence No. Confirms the identity of the firm undergoing the Self Assessment

Start date of P.I. Cover Validates the cover requirements during the Transition Phases

Name of P.I. Scheme / Facility of cover y

Proposed Sum Insured of P.I. Cover y

Proposed Excess of P.I. Cover

Name of person who has completed/verified the information entered into the

Assessment sheet completed by sheet. Should be a Responsible Manager or Compliance Officer.

Date that sheet was completed Date that sheet was completed

Section 2 - Overall Assessment

Please answer all questions on sheet highlighted in bright yellow to generate Overall Assessment ###

Please answer all questions on sheet highlighted in bright yellow to generate Overall Assessment ###

Please answer all questions on sheet highlighted in bright yellow to generate Overall Assessment ###

Section 3 - Assessment Summary

This is the minimum based on the RG126 requirement of at least $2m cover

Minimum Sum Insured Required or the income of your Retail Clients to a maximum of at least $20M.

Overall Risk Loading compared to Base Retail Client This is a subjective assessment of the additional cover required to meet the

Income risk profile of the business based on the information in the model.

This a Compliance rating based on the answers provided by the coverage and

P.I. Policy Coverage / Exclusions Compliance Level exclusions of the P.I. policy.

Cash resources available to the business Value of funds available for potential excesses and uninsured losses.

Estimate of internal financial resources required to This is an assessment of the funds required by the business to meet expected

meet uninsured losses and excesses excesses and uninsured losses (plus a contingency loading).

13741_assessment_tool.xls 07/07/2022 1 of 9

Professional Indemnity Self Assessment Sheet

Surplus business funds available to meet uninsured This is the result of subtracting the internal Financial resources required to

losses and excess meet uninsured losses and excess from the Net Current Assets

13741_assessment_tool.xls 07/07/2022 2 of 9

Professional Indemnity Self Assessment Sheet

Section 4 - Quantitative Risk Assessment Information

Income Details

What was the total Business Income for last financial This figure is used to calculate the level of Retail Client Income, Client

year (As per annual audited accounts)? Numbers / Claim No's and number of representatives are driven by income.

What is the forecast Total Business Income for current This figure is used to calculate the level of Retail Client Income, Client

financial year? $35,000 Numbers / Claim No's and number of representatives are driven by income.

Percentage of Total Business Income Generated from Retail Clients (As per Corps Act definition)

What was the Retail Client percentage of last financial

year income above? This figure is used to calculate the level of Retail Client Income

What is the expected Retail Client percentage of

current financial year income above? This figure is used to calculate the level of Retail Client Income

Retail Client Income Estimate

last Financial Year Estimate $0 RG126 requires your P.I. Sum Insured to at least match your income from

retail clients, with a minimum of $2M up to a maximum of $20M. The system

Current Financial Year Estimate $0 uses the greater of last years income or the forecast income.

Does the proposed P.I. cover include both Retail and If the P.I, cover includes cover for Wholesale Clients the model adjusts for the

Wholesale client coverage? risk of Wholesale Clients exhausting the P.I. cover.

What percentage of the P.I. premium is generated for Any such coverage provided to non AFS Licence activities reduces the

non AFS Licence activities? potential coverage available for Retail Clients

What is the percentage of Retail Income that is

generated from a particular source / scheme / facility / This is used as an indicator of the level of risk to multiple P.I. claims from the

specialised product etc? one event that exists in your business.

Section 5 - Risk Assessment of Business Resources that may be required to meet excesses/uninsured losses

What is the value of Total Current Assets from the last This is used to calculate the potential cash assets available to meet potential

set of audited accounts? excesses and uninsured losses

What is the value of Total Current Liabilities from the This is used to calculate the potential cash assets available to meet potential

last set of audited accounts? excesses and uninsured losses

What is the value of unused overdrafts etc available to This is used to calculate the potential cash assets available to meet potential

the business? excesses and uninsured losses

What is the expected cash flows (Net profit After Tax) This is used to calculate the potential cash assets available to meet potential

from business activities for the current financial year? excesses and uninsured losses

What is the value of loans available from shareholders This is used to calculate the potential cash assets available to meet potential

etc. if required. excesses and uninsured losses

13741_assessment_tool.xls 07/07/2022 3 of 9

Professional Indemnity Self Assessment Sheet

Value of Cash or equivalents potentially available to

meet uninsured losses. $0 Value of funds available for potential excesses and uninsured losses.

13741_assessment_tool.xls 07/07/2022 4 of 9

no reviews yet

Please Login to review.