244x Filetype XLSX File size 0.08 MB Source: www.biophorum.com

Sheet 1: Essential information for user

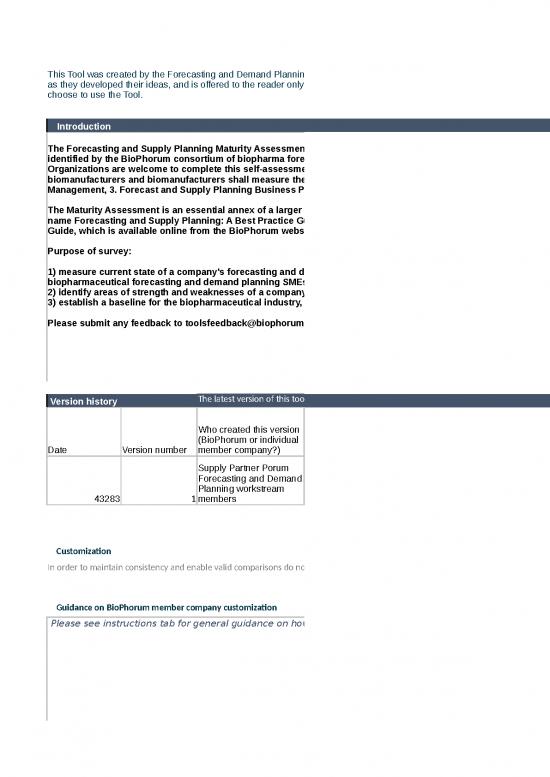

| This Tool was created by the Forecasting and Demand Planning workstream and is available online from the BioPhorum website www.biophorum.com. The Tool was created by the workstream for their own use as they developed their ideas, and is offered to the reader only as a useful example of how the recommendations in this paper can be applied. Companies should follow their own internal QA processes if they choose to use the Tool. | |||

| Introduction | |||

| The Forecasting and Supply Planning Maturity Assessment is designed to measure the current state of a company's forecasting and demand planning process against best industry practices as identified by the BioPhorum consortium of biopharma forecasting and demand planning subject matter experts (SMEs) representing both biopharmaceutical manufacturers and suppliers. Organizations are welcome to complete this self-assessment of how their organization currently works with their key/critical partners. Suppliers shall measure their engagement with biomanufacturers and biomanufacturers shall measure their engagement with suppliers. The survey is broken down into three sections: 1. Relationship Management, 2. Performance Management, 3. Forecast and Supply Planning Business Processes. The Maturity Assessment is an essential annex of a larger piece of work produced by the BioPhorum Supply Partner Phorum Forecasting and Demand Planning workstream that goes under the name Forecasting and Supply Planning: A Best Practice Guide for the Biopharmaceutical Industry. It is recommended that those taking this Maturity Assessment also read the Best Practice Guide, which is available online from the BioPhorum website following this link: https://www.biophorum.com/forecasting-toolkit/ Purpose of survey: 1) measure current state of a company's forecasting and demand planning process against biopharmaceutical best industry practices as identified by the BioPhorum consortium of biopharmaceutical forecasting and demand planning SMEs 2) identify areas of strength and weaknesses of a company's forecasting and demand planning process 3) establish a baseline for the biopharmaceutical industry, as well as for each individual company, enabling progress over time to be tracked. Please submit any feedback to toolsfeedback@biophorum.com with the subject header ‘FDP Maturity Assessments. |

|||

| Version history | The latest version of this tool can be found on the BioPhorum website www.biophorum.com |

||

| Date | Version number | Who created this version (BioPhorum or individual member company?) | Notes |

| 43283 | 1 | Supply Partner Porum Forecasting and Demand Planning workstream members | None |

| Customization | |||

| In order to maintain consistency and enable valid comparisons do not change any part of this tool. Please refer to terms and conditions for guidance and restrictions | |||

| Guidance on BioPhorum member company customization | |||

| Please see instructions tab for general guidance on how to use the Forecasting and Supply Planning Maturity Assessment | |||

| Instructions: Forecasting and Supply Planning Maturity Assessment | ||||||||||||||

| How to approach survey: The Forecasting and Supply Planning Maturity Assessment is designed to be completed by having conversations with subject matter experts (SMEs) from different departments on site that are familiar with current processes and performance of their organization related to relationship management and forecasting and supply planning with key/critical partners within the biopharma industry. Each organization is to assess how they generally perform (not best case, nor worst case) against each attribute and should look for evidence to support their judgements and aim to reach consensus. Scores are then populated in the scoring column for each of the three sections/tabs. General Guidance: • one survey per company • this survey is to measure current state • each company should consider its standard performance with respect to its five to 10 key/critical supply chain partnerships within the biopharma industry • for proper discussion and reflection to take place we recommend completing the survey during two separate 1.5-hour meetings, less than a week apart • recommendation is for a lead to facilitate the taking of the survey within the company, involving two to three SMEs • recommended people to involve in the survey session (two to three people) are: e.g. an end-user/biomanufacturer should consider including: supply chain member, production planning, manufacturing operations, buyer/planner e.g. a supplier should consider including: supply chain member, production planning, customer service, sales (or SMEs with knowledge of inbound market data). Note: try to include both global and site representation where possible. How to score: The assessment is divided into three category groups of best practices: Relationship Management, Performance Management and Business Processes. There are three levels of maturity described for each best practice in a category: • innocence • understanding • best practice. The bullet points described in each level of maturity are not rules, but rather examples to help gauge where the company is. This is a self-assessment and the company SMEs should: • first, through discussion, decide which of the three levels of maturity their company falls into for a particular best practice • second, decide how many points within the range of the selected maturity level their company deserves, 1 being the lowest score and 10 being the highest score. • Innocence level can receive a score from 1-3 • Understanding level can receive a score from 4-7 • Best Practice level can receive a score from 8-10 General guidance: if a company performs all of the described practices in a maturity level most of the time, then it deserves the highest points in that maturity level. To receive the lower-end score in a maturity level, the company will need to perform some of the practices in the category at least some of the time. Only whole numbers are allowed. |

||||||||||||||

| 1.0 Relationship management | ||||

| Best Practice Attributes | Innocence | Understanding | Best Practice | Score |

| (1-3) | (4-7) | (8-10) | Put your score in this column (1-10) | |

| 1.1 Partnership / collaboration | ||||

| 1.1.1 Long term-vision | • Transactional only type of relationship. • Each party develop their long-term vision on their own and not share each others vision with each others. • Unwillingness or lack of understanding for why communication and transparency of long term-vision need to occur cross-functionally and operational alignment. |

• Some degree of collaboration and trust between related departments; e.g. limited to sales team, customer service, and supply chain. • Some transparency on long-term vision • No broad understanding of each others long-term vision throughout each others organization. • Some foundational contracts and agreements. • Little buy in from Senior Leadership |

• Align on long-term visions including roadmaps, key initiatives, ongoing developments. • Full sharing of goals, strategies, tactics in attempting to reflect partners plans into their own. • Enhanced or enforced via contracts or licensing agreements. • Long term vision co-developed. Joint strategic plan in place to drive together toward the shared vision. • Full buy-in from executives of both parties. |

|

| 1.1.2 Joint scenario based planning | • Little information is shared of any kind. Silo, basic MRP • Each party working off of POs, capacity planned off of POs or history. • No communication on mid- to long- term demand or capacity constraints. • No collaboration regarding scenario development or testing. |

• Some sharing of global demand planning on ad hoc basis and capacity constraints to meet that demand. |

• Jointly developed scenario-based planning processes, clarifying working assumptions to ensure supply and optimize capacity and utilization for both partners. • Supply chain networking and process integration across entity boundaries. Externally integrated ERP systems and vendor management inventory. |

|

| 1.1.3 Organized physical meetings | No meetings are scheduled or only when there is a crisis. | • Meetings are rarely held or ad hoc. • Meeting agenda focus is on problem/s and reactionary, rather then on prevention. |

• Regularly scheduled meetings and events to address strategic and tactical aspects. • Open communication of each others processes. • Meetings have a formal agenda • There is a communication plan for each strategic partner that is adapted over time. • Executive level reviews at least once a year. • Alignment on common goals and a complete representation from the entire supply chain. • Extra curricular team building events with supply partner. • In the meeting you can't tell who is from which company because the people in the room are aligned and working towards common goals and representing the whole supply chain. |

|

| 1.1.4 Problem solving and continuous improvement collaboration. | • Transactional/commodity relationship with no willingness to problem solve, e.g. exchange of PO and product, but no collaboration on understanding why something may not be working well. • No joint problem solving methodology. • Each side blaming the other, rather than looking for true root cause. • Little understanding of their counterpart requirements and needs. |

• Some level of collaboration, but lack of alignment in methodologies. • Each party is looking primarily from their own perspective. • Each department focusing on their own priorities and looking to optimize their own area. |

• Alignment on methodologies • Working collaboratively as one team to get to root cause. • Formal Total Cost of Ownership process as dictated in vendor agreements to collaboratively reduce waste in the supply chain. • RACI has been created and implemented |

|

| 1.1.5 Transparency | • Nothing is shared amongst the two parties (lessons learned, processes) or only enough to support current business dealings | • Only allowed via formal Supplier Relationship Management initiatives • No sharing of lessons learned or processes • Total Cost of Ownership not established • Lack of clear communication |

• Share issues openly, including lessons learned • Externally Integrated ERP ,VMI, Total Cost of Ownership lessons learned. • Sharing of for e.g. process knowledge, scrap figures, capacity, constraints. • Multi-tiered visibility of standard information. • Pipeline information. • Being clear on what information cannot be shared and why. |

|

| 1.2 Optimized agreements | ||||

| 1.2.1 Roles and Responsibilities | • Each organization defines their own roles and responsibilities • Little to no definition of who does what or how between the two organization |

• Some understanding of each organizations org structure and individuals' responsibilities • Some understanding or agreement on how things are to happen and some collaboration or alignment on defining roles and responsibilities across the relationship. |

• Roles and responsibilities collaboratively defined between the two organization documented in detail including expectations around how and when things happen. • Roles and responsibilities periodically reviewed and updated based on team learning. • How roles and responsibilities will be executed are documented, periodically reviewed and improved upon. |

|

| 1.2.2 Mutual requirements | • No thought of the other partners needs and requirements. • Little to no advanced sharing of organizational needs. • Staffing and budget requirements are not planned for. |

• Each party has a fairly good understanding of some of each other's needs. • Key requirements documented. • Each party focuses on ensuring their own requirements are being met. • Key initiatives are properly staffed and budgeted within each others departments. |

• Requirements are collaboratively documented and prioritized based on potential impact to the entire value stream. • Partners see each other's requirements as equally important as their own. • Staff and budget is fully allocated by both parties in support of mutually agreed priorities |

|

| 1.2.3 Risk Sharing | • Each partner has their own process for identifying risks with little to no understanding of their partners' risks or risk process. • Each partner looks to minimize risks to their business with little to no consideration of the risks or costs that may be incurred by their partners. |

• Each partner has an understanding of each other's top risks within the shared supply chain. • There is some good faith sharing of risks but the focus is still for each partner to minimize their own risks |

• Partners work collaboratively to identify and prioritize risks along the shared supply chain irrespective of where the risks lie. • Risks (i.e. holding inventory) are optimized from the perspective of the entire supply chain in where burdens are shifted from one partner to another, a clear process exists to balance out (share) the burden. |

|

| 1.2.4 Contract Management (legal documents) | • Organization work off of purchase order terms and conditions, as well as confirmation terms and conditions, with some email or verbal commitment. | • Each party is trying to get the best terms they can in the contract. • Master supply agreement exist that has been negotiated between partners with each organization representing themselves and working to define scope, key agreed deliverables in terms of quantity, timing,...responsibilities, legal. • Document is used as a reference to resolve issues (if expectations are not being met, the contract can be reviewed to determine if properly covered or if the agreement is not being adhered to). |

• Agreement was collaboratively developed and document contains all of the key deliverables within the value chain (including quality, timing,..) needed to meet joint operational and strategic goals. • Document covers the "What" in detail, but does not cover how. How you do things should be left in non-legal agreement because they describe more dynamic working relationships. |

|

| 1.3 Replenishment strategy | • Each party plans their own business with no understanding, concern, or consideration of the other party's constraints, needs, or planning methods. |

• Some understanding of each other's business processes and constraints are known, i.e. lead time, and are considered to some extent in the planning process. • Ad-hoc review of key master data elements, minimal review of historical performance and adaptation. |

• Both parties share a robust business process of reviewing joint historical performance data, such as lead time, forecast accuracy, … to jointly determine the most appropriate replenishment strategy. • Both parties work together to implement the replenishment strategy which is set up using the same master data at both supply partner, and Bio Manufacturer • Timely updates: regularly scheduled review (every 6 months - 1 years) and immediate review upon material changes in demand. |

|

| 1.4 Determine a segmentation of the portfolio for both Biomanufacturer and Supply Partners. | • No prioritization and/or lack of segmentation • Both parties treat each other the same way they treat all of their suppliers/customers. • Strategic relationship have not been defined and/or communicated. |

• Both parties have some form of segmentation process. • Both parties have communicated and are aligned on the segmentation, but it is not yet implemented. |

• Both parties have segmented their customers/suppliers and have communicated such segmentation to their partners. • Different relationship types have been specified based on a set of factors relating to impact on organizational strategy. • Identified and recognized potential value-add and innovation opportunities: taking into account costs, risks, volumes and impact on each other’s’ area of business. • Both parties are fully aware of each other's segmentation process and understand what drivers exist to move up or down the segmentation ladder. |

|

| Total Score | 0 | |||

| Average Score | 0 | |||

no reviews yet

Please Login to review.