| HOW TO USE THE ANZ CASH FLOW FORECAST TEMPLATE |

|

|

|

|

|

|

|

|

|

|

|

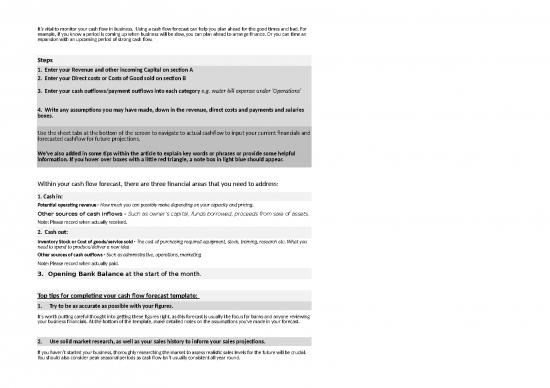

| It’s vital to monitor your cash flow in business. Using a cash flow forecast can help you plan ahead for the good times and bad. For example, if you know a period is coming up when business will be slow, you can plan ahead to arrange finance. Or you can time an expansion with an upcoming period of strong cash flow. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Steps |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Enter your Revenue and other incoming Capital on section A |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Enter your Direct costs or Costs of Good sold on section B |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. Enter your cash outflows/payment outflows into each category e.g. water bill expense under 'Operations' |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. Write any assumptions you may have made, down in the revenue, direct costs and payments and salaries boxes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use the sheet tabs at the bottom of the screen to navigate to actual cashflow to input your current financials and forecasted cashflow for future projections. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| We’ve also added in some tips within the article to explain key words or phrases or provide some helpful information. If you hover over boxes with a little red triangle, a note box in light blue should appear. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Within your cash flow forecast, there are three financial areas that you need to address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Cash in: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Potential operating revenue - How much you can possibly make depending on your capacity and pricing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other sources of cash inflows - Such as owner’s capital, funds borrowed, proceeds from sale of assets. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note: Please record when actually received. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Cash out: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory Stock or Cost of goods/service sold - The cost of purchasing required equipment, stock, training, research etc. What you need to spend to produce/deliver a new idea |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other sources of cash outflows - Such as administrative, operations, marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note: Please record when actually paid. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. Opening Bank Balance at the start of the month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Top tips for completing your cash flow forecast template: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Try to be as accurate as possible with your figures. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| It's worth putting careful thought into getting these figures right, as this forecast is usually the focus for banks and anyone reviewing your business financials. At the bottom of the template, make detailed notes on the assumptions you've made in your forecast. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Use solid market research, as well as your sales history to inform your sales projections. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| If you haven’t started your business, thoroughly researching the market to assess realistic sales levels for the future will be crucial. You should also consider peak seasonal periods as cash flow isn’t usually consistent all year round. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. Check your capacity. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| If you estimate your cash flow for a month is $50,000, consider how feasible this number really is. There are only so many hours in the day and you’ll only be able to deal with a certain number of customers. Also, even if you invoice $50,000 of sales in a month, you can’t guarantee the full amount will be paid on time. For example, you might estimate 80% of invoices are paid in the month of billing, 10% a month later, and 10% two months later. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. Find benchmarks for profit in your industry. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| If yours are very different from the average, people assessing your business will want to know why. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5. Make sure your own salary is realistic. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| It's a balance between paying yourself too much and not paying enough to meet your expenses. Consider your personal living expenses too. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6. Don't forget one-off items like accounting fees and tax obligations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Many businesses struggle to find the cash to pay taxes when they’re due. Your accountant can help you estimate what your tax obligations are likely to be. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7. It’s always a good idea to run your figures past an accountant. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Do this before presenting your cash flow forecast to outside readers, such as potential lenders or investors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8. Remember that locking in core business should always be a priority. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Many businesses make the mistake of coming up with a really good idea to grow their business, only to never work out if they can make a profit. Often the new idea can drain your cash, time, employee time and other resources. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disclaimer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| This document is intended to provide general information only and should not be relied upon in substitution for professional legal or financial advice. Whilst due care has been taken in preparing the document, no warranty is given as to the accuracy of the information contained in the document. The accuracy of the output from the document is subject to the accuracy of the information you provided. ANZ will not store the information provided in the document. To the extent permitted by law, no member of the ANZ group of companies shall be liable to any person for any error or omission contained in the document or for any loss or data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (ANZ). ANZ's colour blue is trade mark of ANZ. This guide contains general information only. Its content is for information purposes only, is subject to change and is not a substitute for commercial judgement or professional advice. This material does not take into account your personal and financial needs and/or circumstances, and you should seek appropriate advice (which may include property, legal, financial and/or taxation advice) before considering any material further. To the extent permitted by law, ANZ disclaims liability or responsibility to any person for any direct or indirect loss or damage that may result from any act or omission by any person in relation to the material contained in this guide. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| THE ANZ SMALL BUSINESS CASH FLOW FORECAST TEMPLATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Read our handy tips before completing your forecast - you can find them on the first tab. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECT A MONTH TO START |

ASSUMPTIONS |

JULY |

AUGUST |

SEPTEMBER |

OCTOBER |

NOVEMBER |

DECEMBER |

JANUARY |

FEBRUARY |

MARCH |

APRIL |

MAY |

JUNE |

TOTAL |

|

|

| (A) Revenue |

TIP: Insert any assumptions you've made in this column

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

TIP: Use Notes to create comments to explain your inputs (Review tab > Notes) e.g. a sale being held this month that improved your revenue.

$- |

$- |

$- |

$- |

|

|

|

TIP: If you contribute money into the business, you can put this here.

Owner's capital |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| (B) Direct costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Materials/Purchases |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Subcontractor payments |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Freight & Cartage |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| COST OF GOODS SOLD |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| (C) Gross cash flow (A-B) |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| PAYMENTS/OUTFLOWS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Bank Fees |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Legal fees |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Interest |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Loan repayments may vary from month to month if your loan is on a variable rate

Debt repayments |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Tax |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Insurance |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Subscriptions |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Computers and software |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Assuming that there is no major business expansions (including new hire), the operating costs should remain relatively the same as previous months/years

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cleaning |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Equipment hire/lease |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Ensure this number is aligned with your projected marketing activities for the next 6-12 months

Marketing and advertising |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Motor vehicle expenses |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Power |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Rent and rates |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Repairs and maintenance |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Ensure the number is aligned, particularly if you are looking to expand or add new staff to your business

Salaries and employee expenses |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Stationery |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Sundries |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Telephone |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Uniforms |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Water |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Use this section to include any extra cash outflows

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

| (D) Total payments/outflows |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET CASH FLOW (C-D) |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

TIP: Enter your bank balance for the start of the month in cell reference D48

Opening bank balance |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CLOSING BANK BALANCE |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use these boxes to provide details of any assumptions you've made when calculating your figures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

Direct Costs |

|

|

|

Payments and Salaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outline how you calculated your forecasts and explain the main variances. Examples include average spend per customer and debt as a percentage of revenue. |

|

|

Detail major costs and any significant variances between months. |

Explain your payments in detail and any significant

variation from month to month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| This document is intended to provide general information only and should not be relied upon in substitution for professional legal or financial advice. Whilst due care has been taken in preparing the document, no warranty is given as to the accuracy of the information contained in the document. The accuracy of the output from the document is subject to the accuracy of the information you provided. ANZ will not store the information provided in the document. To the extent permitted by law, no member of the ANZ group of companies shall be liable to any person for any error or omission contained in the document or for any loss or damage suffered by any person relying on the information contained in the document. |

|

|

|

|

|

|

|

THE ANZ SMALL BUSINESS CASH FLOW FORECAST TEMPLATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This tab features an example cash flow template with instructions and tips for how to make your own. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Below is an example of a Business that has a cash need just prior to their peak cash sales at Christmas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECT A MONTH TO START |

ASSUMPTIONS |

JULY |

AUGUST |

SEPTEMBER |

OCTOBER |

NOVEMBER |

DECEMBER |

JANUARY |

FEBRUARY |

MARCH |

APRIL |

MAY |

JUNE |

TOTAL |

|

|

|

Business Background |

| (A) Revenue |

TIP: Insert any assumptions you've made in this column

See Revenue calculation below this table. |

$70,006.00 |

$64,896.00 |

$54,340.00 |

$64,719.00 |

$84,420.00 |

$120,900.00 |

$35,178.00 |

$40,248.00 |

$55,860.00 |

TIP: Use Notes to create comments to explain your inputs (Review tab > Notes) e.g. a sale being held this month that improved your revenue.

$70,200.00 |

$49,920.00 |

$71,250.00 |

$781,937.00 |

|

|

|

Business Entity |

ABC Pty Ltd (Sole Director) |

|

|

|

|

|

|

|

|

|

|

|

TIP: If you contribute money into the business, you can put this here.

Owner's capital |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

Industry |

Retail store selling camping gears and clothings including ski equipments during the winter period. |

|

|

|

|

|

|

|

|

|

|

| (B) Direct costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Materials/Purchases |

|

$35,000.00 |

$30,000.00 |

$30,000.00 |

$50,000.00 |

$40,000.00 |

$45,000.00 |

$10,000.00 |

$15,000.00 |

$30,000.00 |

$30,000.00 |

$30,000.00 |

$35,000.00 |

What is your industry benchmark according to the ATO?

$380,000.00 |

|

|

|

Purpose |

Business to check if additional funding is required to support Christmas sales in December and ongoing sales activities. |

|

|

|

|

|

|

|

|

|

|

| Subcontractor payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freight & Cartage |

In this example, Freight costs have been included within Material invoices. |

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

Business Tenure |

1 year trading - an established business. |

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD |

|

$35,000.00 |

$30,000.00 |

$30,000.00 |

$50,000.00 |

$40,000.00 |

$45,000.00 |

$10,000.00 |

$15,000.00 |

$30,000.00 |

$30,000.00 |

$30,000.00 |

$35,000.00 |

$380,000.00 |

|

|

|

Business Needs |

$30,000 Overdraft is required to support Christmas Sales activities. |

|

|

|

|

|

|

|

|

|

|

|

|

(C) Gross cash flow (A-B) |

|

$35,006.00 |

$34,896.00 |

$24,340.00 |

$14,719.00 |

$44,420.00 |

$75,900.00 |

$25,178.00 |

$25,248.00 |

$25,860.00 |

$40,200.00 |

$19,920.00 |

$36,250.00 |

What is your Gross Profit as a percentage to your sales?

$401,937.00 |

|

|

|

|

This is evident from the net cash flow position at H48 and also K48, L48, M48 and O48 which have shown the permanent Overdraft arrangement is required. |

|

|

|

|

|

|

|

|

|

|

|

|

PAYMENTS/OUTFLOWS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Location |

High street retail business located in regional town close to the ski field area. |

|

|

|

|

|

|

|

|

|

|

|

Accounting |

|

|

$2,400.00 |

|

$400.00 |

|

|

$400.00 |

|

|

$400.00 |

|

|

$3,600.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Fees |

Merchant + Fees |

$609.05 |

$569.70 |

$488.42 |

$568.34 |

$720.03 |

$1,000.93 |

$340.87 |

$379.91 |

$500.12 |

$610.54 |

$454.38 |

$618.63 |

$6,860.91 |

|

|

|

Note |

All figures are GST Exclusive. It is very important to consider GST payments if you are going to be including GST in your cash flow forecast. |

|

|

|

|

|

|

|

|

|

|

|

Bank facility fees |

Facility Fees |

$350.00 |

|

|

$350.00 |

|

|

$350.00 |

|

|

$350.00 |

|

|

$1,400.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

Overdraft Interest |

|

|

|

$300.00 |

$150.00 |

$100.00 |

|

|

|

|

|

|

$550.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Loan repayments may vary from month to month if your loan is on a variable rate

Debt repayments |

Term Loan + Asset Finance |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$1,886.00 |

$22,632.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance |

Insurance includes building, stock and public liability |

$1,800.00 |

|

|

$1,800.00 |

|

|

$1,800.00 |

|

|

$1,800.00 |

|

|

$7,200.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscriptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Computers and software |

|

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$1,500.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Assuming that there is no major business expansions (including new hire), the operating costs should remain relatively the same as previous months/years

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cleaning |

|

$280.00 |

$280.00 |

$280.00 |

$280.00 |

$350.00 |

$350.00 |

$140.00 |

$140.00 |

$280.00 |

$280.00 |

$280.00 |

$280.00 |

$3,220.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment hire/lease |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Ensure this number is aligned with your projected marketing activities for the next 6-12 months

Marketing and advertising |

|

|

|

|

$15,000.00 |

|

|

|

|

$5,000.00 |

|

$7,500.00 |

|

$27,500.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Motor vehicle expenses |

|

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$125.00 |

$600.00 |

$125.00 |

$125.00 |

$125.00 |

$1,200.00 |

$3,050.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Power |

|

$1,000.00 |

$1,000.00 |

$1,000.00 |

$1,100.00 |

$1,150.00 |

$1,300.00 |

$1,300.00 |

$13,000.00 |

$1,200.00 |

$1,100.00 |

$1,000.00 |

$1,000.00 |

$25,150.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rent and rates |

|

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

$6,666.00 |

Is your rental as a percentage of sales in line with your industry?

$79,992.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repairs and maintenance |

|

|

|

$1,000.00 |

|

|

|

$2,000.00 |

|

|

|

|

|

$3,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Ensure the number is aligned, particularly if you are looking to expand or add new staff to your business

Salaries and employee expenses |

1 Full Time, 2 Part Time |

$7,046.00 |

$7,046.00 |

$7,046.00 |

$7,046.00 |

$10,166.00 |

$10,166.00 |

$5,500.00 |

$5,500.00 |

$7,046.00 |

$7,046.00 |

$5,500.00 |

$7,046.00 |

Is your wages expense in line with industry benchmarks?

$86,154.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stationery |

|

|

|

|

$200.00 |

|

|

|

|

$200.00 |

|

|

$200.00 |

$600.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sundries |

|

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$120.00 |

$1,440.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$150.00 |

$1,800.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Uniforms |

|

|

|

|

$400.00 |

|

|

|

|

|

|

$1,200.00 |

|

$1,600.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water |

Water Rates and Usage |

$300.00 |

|

|

$300.00 |

|

|

$300.00 |

|

|

$300.00 |

|

|

$1,200.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Use this section to include any extra cash outflows

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors salary |

|

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$5,500.00 |

$66,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(D) Total payments/outflows |

|

$25,957.05 |

$25,867.70 |

$24,386.42 |

$42,316.34 |

$27,108.03 |

$27,488.93 |

$26,702.87 |

$34,066.91 |

$28,798.12 |

$26,458.54 |

$30,506.38 |

$24,791.63 |

$344,448.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH FLOW (C-D) |

|

$9,048.95 |

$9,028.30 |

$(46.42) |

$(27,597.34) |

$17,311.97 |

$48,411.07 |

$(1,524.87) |

$(8,818.91) |

$(2,938.12) |

$13,741.46 |

$(10,586.38) |

$11,458.38 |

This is your business earnings before tax and depreciation

$57,488.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIP: Enter your bank balance for the start of the month in cell reference E49

Opening bank balance |

|

$2,000.00 |

$11,048.95 |

$20,077.25 |

$20,030.84 |

$(7,566.50) |

$9,745.47 |

$58,156.54 |

$56,631.67 |

$47,812.76 |

$44,874.63 |

$58,616.09 |

$48,029.71 |

$59,488.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLOSING BANK BALANCE |

|

$11,048.95 |

$20,077.25 |

$20,030.84 |

$(7,566.50) |

$9,745.47 |

$58,156.54 |

$56,631.67 |

$47,812.76 |

$44,874.63 |

$58,616.09 |

$48,029.71 |

$59,488.09 |

$116,976.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use these boxes below to provide details of any assumptions you've made when calculating your figures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

How Revenue was calculated for this example? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*all figures are ex GST.

Sales pick up at Christmas as we send out a sale catalogue in the paper and invest $15,000 in marketing over 2nd qtr.

Sales also pick up during the easter holidays as people purchase goods for travelling and tourists also come to the area.

We also diversify during winter and stock wet weather and ski clothing. * average sale is $57. * Only trade 6 days per week during quieter months and trading 7 days per week in busier months. |

Note

The shortfall of funds in October as purchases increase in preperation for Christmas sale - we need to have the stock on hand as Christmas is fast paced shopping without the time to do customer orders hence the request for a $30,000 overdraft facility. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July |

August |

September |

October |

November |

December |

Jan |

Feb |

March |

April |

May |

June |

|

Annual |

|

|

|

|

|

|

|

|

|

|

|

Customers Per Day |

34 |

48 |

38 |

51 |

67 |

65 |

33 |

39 |

35 |

45 |

32 |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Sale |

$71.00 |

$52.00 |

$55.00 |

$47.00 |

$42.00 |

$62.00 |

$41.00 |

$43.00 |

$57.00 |

$60.00 |

$60.00 |

$95.00 |

|

$57 |

Average sale over the year |

|

|

|

|

|

|

|

|

|

|

|

|

Days of Trade |

29 |

26 |

26 |

27 |

30 |

30 |

26 |

24 |

28 |

26 |

26 |

30 |

|

328 |

Trading days in a year |

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Sales |

$70,006.00 |

$64,896.00 |

$54,340.00 |

$64,719.00 |

$84,420.00 |

$120,900.00 |

$35,178.00 |

$40,248.00 |

$55,860.00 |

$70,200.00 |

$49,920.00 |

$71,250.00 |

|

$781,937.00 |

Annual turnover (exclusive GST) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank fees are based on having 2 merchant facilites @ $35 each and fees of 1%. Expect EFTPOS transactions to make up 70% of sales.

COGS (Cost of Goods Sold) are actually 42% but we will build up stock holdings by $51,000 during the year.

Purchases drop in Jan and Feb as are still carrying over some stock from Christmas and will try to clear that in these months with boxing day sales, back to work sales.

Marketing has been budgeted for Christmas sale, easter sale and also winter sale periods.

Rent and rates are in line with industry standards at 10% of revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments and Salaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salares are for one full time and two permanent part time staff.

Hours for PPT staff are increased during busy periods and also account for extra weekend week/penalty rates.

Owner will work on the floor during peak times and when other staff are on annual/sick leave. Figures have included super contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DISCLAIMER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This document is intended to provide general information only and should not be relied upon in substitution for professional legal or financial advice. Whilst due care has been taken in preparing the document, no warranty is given as to the accuracy of the information contained in the document. The accuracy of the output from the document is subject to the accuracy of the information you provided. ANZ will not store the information provided in the document. To the extent permitted by law, no member of the ANZ group of companies shall be liable to any person for any error or omission contained in the document or for any loss or damage suffered by any person relying on the information contained in the document. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|