278x Filetype PDF File size 0.07 MB Source: itre.ncsu.edu

Professional

Development

Associates

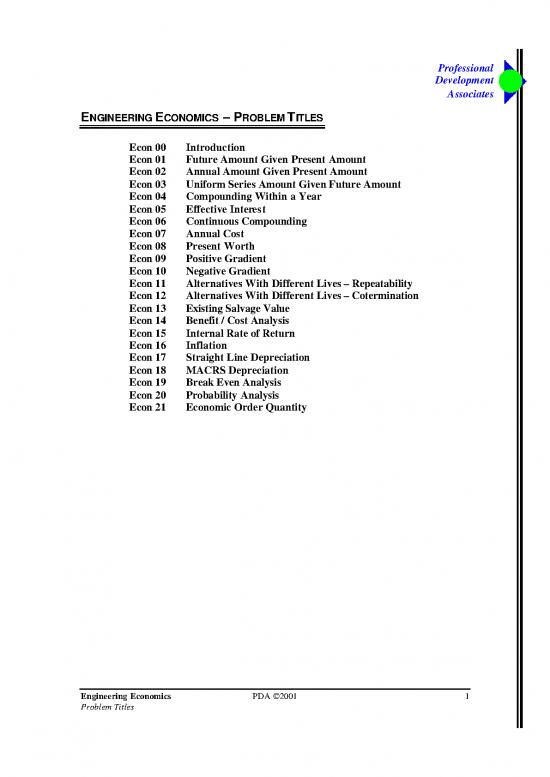

ENGINEERING ECONOMICS – PROBLEM TITLES

Econ 00 Introduction

Econ 01 Future Amount Given Present Amount

Econ 02 Annual Amount Given Present Amount

Econ 03 Uniform Series Amount Given Future Amount

Econ 04 Compounding Within a Year

Econ 05 Effective Interest

Econ 06 Continuous Compounding

Econ 07 Annual Cost

Econ 08 Present Worth

Econ 09 Positive Gradient

Econ 10 Negative Gradient

Econ 11 Alternatives With Different Lives – Repeatability

Econ 12 Alternatives With Different Lives – Cotermination

Econ 13 Existing Salvage Value

Econ 14 Benefit / Cost Analysis

Econ 15 Internal Rate of Return

Econ 16 Inflation

Econ 17 Straight Line Depreciation

Econ 18 MACRS Depreciation

Econ 19 Break Even Analysis

Econ 20 Probability Analysis

Econ 21 Economic Order Quantity

Engineering Economics PDA 2001 1

Problem Titles

This page intentionally left blank.

2 PDA 2001 Engineering Economics

Professional

Development

Associates

ENGINEERING ECONOMICS – INTRODUCTION

In many ways, your household expenses highest worth alternative. The interest

dealing with loans fit into engineering rate used in the analysis has a direct

economic principles. These principles bearing on the best alternative. A worth

involve the economic analysis of analysis can turn out to be either positive

alternatives. For many problems, the or negative. A positive worth means the

time value of money (interest rate) is alternative is acceptable at the interest

used to move cash flow from one point rate used in the analysis. It also

in time to another point in time. This is represents the additional worth earned

referred to as getting an equivalent value above the interest rate used. Further, it

for the cash flow at one specific point or indicates that the internal rate of return

series in time (present, uniform series, or (the actual return earned on the

future). One principle used is that the investment) is greater than the interest

interest rate must match the rate used in the analysis. Do not be

compounding frequency. For example, fooled by a negative answer. This only

use monthly interest for monthly means the alternative is not acceptable at

compounding. the interest rate used. It does not mean

the alternative has lost money (although

Many economic analysis problems that could happen). It does tell you that

involving interest rate can be solved the internal rate of return is below the

using one of these analysis techniques: interest rate used in the analysis.

§ Annual Cost (or Worth) The internal rate of return is the actual

§ Present Cost (or Worth) interest earned by the investment. Only

§ Future Cost (or Worth) a worth alternative has an internal rate of

§ Internal Rate of Return return. A cost alternative does not have

§ Benefit Cost Analysis an internal rate of return. A common

way to determine the internal rate of

A cost analysis is one where almost all return is to write the present worth

the dollars are going out (except salvage equation and set it equal to zero. If there

value). You want to choose the are two or more different factors, then

alternative with the least cost. The least solve by trial and error by selecting an

cost alternative will be the same one interest rate that comes closest to having

regardless of the interest rate used in the the present worth equal zero. For the FE

analysis. The top three techniques rely exam, select either (B) or (C) to get

on the same principles of moving cash started. If the present worth is positive

flows to the desired analysis reference (greater than zero), select a higher

point (annual, present or future). Annual interest rate. If the present worth is

costs are a type of uniform series negative (below zero), select a lower

amount. interest rate. One of the answers should

result in the present worth being very

A worth analysis is where an income is close to zero.

present in addition to expenses. For

these problems, you want to choose the

Engineering Economics PDA 2001 3

Introduction

Benefit cost analysis can be used for a You are likely to be tested on

single alternative and also for comparing depreciation. Depreciation is used to

alternatives. These problems are best estimate the book value of an item at

analyzed by converting all benefits and some point in time. It is also used to

all costs into equivalent annual amounts. reduce taxes. The two types of

In this manner, any differences in the depreciation mentioned in the FE

lives of alternatives can be ignored. Reference Handbook are straight line

Some problems may look like they only and MACRS. Straight line is very

have costs and no benefits. In this case, simple. Modified Accelerated Cost

look for a reduction in some common Recovery System was started by the

cost to be the benefit in comparing IRS to both simplify tax accounting and

alternatives. create favorable cash flow in the early

years of a new company. Carefully look

Some specialized elements of cash flows over these depreciation techniques.

that you could see on the exam include

gradients (positive and negative), Some other types of analysis that do not

continuous compounding, effective rely on interest rate are break even

interest, alternatives with different analysis, probability analysis, and

lives, and inflation. Carefully review economic order quantity. You may see

these problem solutions on the CD if you one or more of these problems on your

are unfamiliar with them. exam, so carefully review the principles

behind them.

4 PDA 2001 Engineering Economics

Introduction

no reviews yet

Please Login to review.